The planned Polar Connect submarine connection from Northern Europe to East Asia, strengthening European digital sovereignty, is in high demand. A report commissioned by NORDUnet outlines possible models for public financing and regulation.

The argument for submarine fibre connections linking Europe to Asia and North America through the Arctic Ocean is strong. However, due to market failures, societal benefits such as increased European digital sovereignty, lower latency, and a higher level of redundancy in capacity are not reflected directly as incentives for private investors. Therefore, initial public funding is needed to get things moving – a case that policymakers have recognised. A new Copenhagen Economics report commissioned by NORDUnet has appraised the situation and delivered findings to assist with the policy design of public financing.

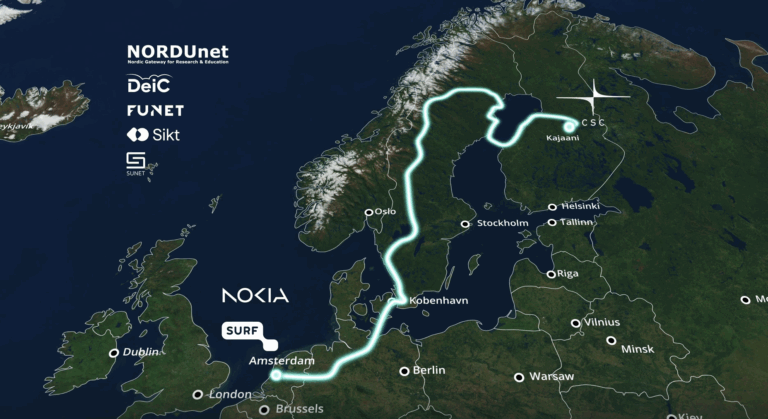

In recent years, the Nordic national research and education networks (NRENs) and NORDUnet have intensified their efforts to exploit progress in cable laying technology which has opened the field for connections through the Arctic Ocean. Polar Connect is planned to take a route east of Greenland, almost touching the North Pole, and make landfall in Japan and South Korea. Along the way, landfall will also be made in Northern Canada and Alaska.

“With Polar Connect, we are creating a high-performance piece of connectivity on a short and unique route, through the Arctic Ocean, uniting Europe and countries in East Asia for a stronger digital future for those involved,” says Erik-Jan Bos, Senior Advisor at NORDUnet.

Current gateways are under pressure

The project is well aligned with EU and international policies aiming to increase capacity and resilience for the world’s digital infrastructures and avoid congestion on the current gateways in a time of geopolitical tension. This is not least true for the Red Sea where hostile activities that could potentially threaten submarine cables have already occurred.

Cables through the Arctic region are, moreover, planned to be equipped with sensors which monitor sea bottom movements, temperature, salinity, and provide other scientific data for one of the least explored regions on the planet.

“Polar Connect will be breaking the ice for a better-connected world, where digital sovereignty for Europe and East Asian countries will meet the forefront of innovation in a number of areas, including sensors on the cable to better understand climate change,” Erik-Jan Bos notes.

Unlocking under-investment problems

Under ideal market conditions, the many advantages associated with Polar Connect would translate into private investors being keen to fund the project. However, since the project will literally cover new ground many uncertainties persist, leading to hesitation among investors.

“Insofar as societally beneficial investments would not materialise through private investment; governments can provide public financial support to unlock any “under-investment” problems,” notes the Copenhagen Economics report, continuing:

“Carefully targeted public funding can be warranted to de-risk the investment, and improve the business case, for commercial investors.”

The Copenhagen Economics report details several possible models and policy design features, known from other international infrastructure projects, for funding and ownership.

Pros and cons of different models

One model for funding and ownership has a single private investor to be responsible for financing the cable. This model enables swift decisions but leaves it for the investor to carry the entire burden of risk. An example of the single investor model is Dunant, the Google-owned transatlantic cable connecting Virginia Beach to the French Atlantic coast.

Another model sees multiple industry players collaborate in a consortium to build a cable, pooling resources and sharing the risks. This model has traditionally been the most common for cable-laying projects and continues to be so. While the sharing of risk is a significant advantage, a down-side is the need for all members of a consortium to agree on decisions. Further, possible conflicts of interest between consortium members must be managed. An example of the consortium model is the dual submarine cable system INDIGO, connecting Singapore to Australia, and Perth (Western Australia) to Alexandria (Eastern Australia). The consortium includes Australian NREN AARNet and five industry partners.

A third model, known as the SPV (Special Purpose Vehicle) model, sees multiple industry players form an entity with a distinct legal status to finance and manage the cable. One purpose is to insulate parent companies from financial risk. Like consortia, the SPV model allows private and public entities to come together under one umbrella. For the Africa Coast to Europe (ACE) submarine cable, several SPVs for various sub-projects were set up while overall management was with a 20-member consortium.

Approaches for public funding

A further design feature concerns approaches for public funding. For example, in the Anchor Tenant Model, the public sector provides funding to a publicly owned and accountable entity that acts as the anchor tenant. With this financial backing the public entity can purchase pre-sold capacity on the cable. This helps de-risk the business case for equity and lending finance to commit to supporting the project.

Moreover, the Tender Model and the Direct Procurement Model provide further options where a public entity funds the development of a project in a more direct manner, including being more closely involved in key project specifications, e.g. in the interest of serving a public objective.

The report does not recommend any one model, but describes the pros and cons of each, leaving it for policymakers to decide in close collaboration with the Polar Connect consortium.

“European and global policymakers have a range of options to improve outcomes in submarine cables. They have a choice between traditional, more hands-off, possibly slower, less effective approaches, and more direct forms of intervention” says Dr. Bruno Basalisco, Director at Copenhagen Economics.

The report “Implementation of the Polar Connect submarine cable – Public financing design options and economic regulatory implications,” prepared for NORDUnet by Copenhagen Economics, was published in early 2024